How to Form an LLC in California? (8-Steps) Guide for LLC in CA

Jump to Best LLC Formation Services in California

If you want to start a small (or big) business in California, congratulations, you are joining nearly 4 million other entrepreneurs in one of the most industrious states out there. Out of these, one of the most common business types used is a Limited Liability Company (LLC).

This is because LLCs offer legal protection, potentially lower taxation, and a great deal of flexibility. However, before you get started, California has a lot of regulations you need to follow. In addition, there are some costs associated with CA LLC, to find out more — check out our guide on California LLC costs.

So, let us get started and show you how you can start and file your LLC. We will break down all you need to know and show you how to form an LLC in California.

- Jump to Best LLC Formation Services in California

- A Quick California LLC Creation Video Guide (For Those Who Don’t Like to Read)

- Step-by-Step Instructions For Forming an LLC in California

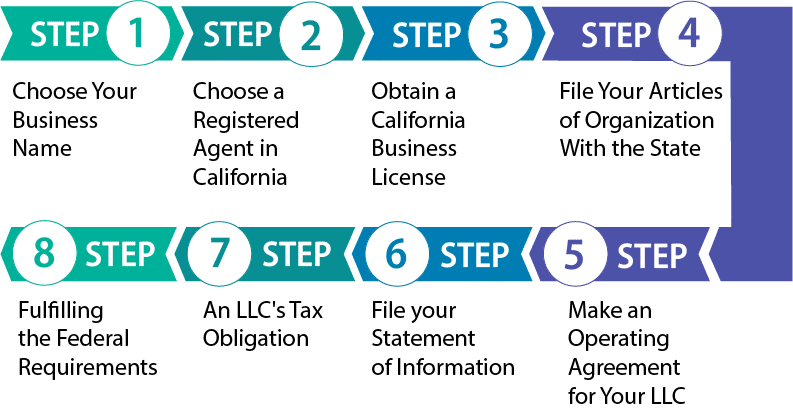

- Step 1: Choose Your California Business Name

- Step 2: Choose a Registered Agent in California

- Step 3: Obtain a California Business License

- Step 4: File Your Articles of Organization With the State

- Step 5: Make an Operating Agreement for Your CA LLC

- Step 6: File Your Statement of Information

- Step 7: An LLC’s Tax Obligation

- Step 8: Fulfilling the CA Federal Requirements

- Pros and Cons of Forming an LLC in California

- Want Some Affordable Help in Forming an LLC? — Here Are The Best LLC Formation Services to Start an LLC in California

- Conclusion

- F.A.Q.s About California’s LLCs

A Quick California LLC Creation Video Guide (For Those Who Don’t Like to Read)

Step-by-Step Instructions For Forming an LLC in California

To start, you need to register your business with the Secretary of State of California. The Secretary of State has the power to define the fees and rules for businesses looking to file as LLCs.

So, here are the basic steps the Secretary requires for registering your LLC:

Step 1: Choose Your California Business Name

The first thing you will need to do is choose your new business’s name. Your name must be unique and must be easily distinguishable from other businesses’ names without causing confusion.

Also, the following words may not be used at least without special permissions: trustee, trust, bank, corp., incorporated, inc., corporation, or anything that would indicate you are in the business of insurance. Additionally, no names may be easily confusable with a government agency.

Your name must end with the words “Limited Liability Company,” “LLC,” or “LLC” You may abbreviate the terms in the following ways “Limited” as “Ltd.” and “Company” as “Co.”

To check if a name is already taken, you can use the Secretary of State’s business search tool. After finding a seemingly available name, you can confirm it by sending a Name Availability Inquiry Letter to California’s Secretary of State’s office. Generally, processing this request will take about two business days.

If you wish to guarantee your chosen name is not taken before forming your LLC, you may reserve a name for your business for up to 60 days. To reserve a name, you must submit a Name Reservation Request Form.

You may reserve up to three names if you would like options. Though this process is not free; and you will have to submit $20 with your name reservation request for reservation and handling fees.

Keep in mind that a name availability request or reservation does not mean the name will not conflict with other trademarks. You and/or your attorney are responsible for ensuring your business name is compatible with all applicable requirements.

Step 2: Choose a Registered Agent in California

California requires all LLCs to possess a registered agent. This is an individual or company who is slated to receive all official communication from the State pertaining to your business.

The following are the requirements for an individual to qualify for serving as a registered agent.

As long as a member of your LLC meets these requirements, they can serve as your registered agent. However, this may be risky. After all, if you miss showing up to the office one day and someone tries to deliver legal documents, and you aren’t there, you could be in legal trouble.

Due to this, many LLCs choose another service to serve as their registered agent. This could be a lawyer or one of many online services that are far more affordable. Regardless of who you choose, this can remove the risk of someone not being present to receive legal communications.

Step 3: Obtain a California Business License

Pretty much all small businesses in California are required to file for a business license, no matter what they do. The most common type of license for small businesses in this State is a general business license, known in some localities as a business tax certificate. These licenses are issued by the local city or town, and if you do business in multiple localities, you will need multiple licenses.

Some professions require certain professional licenses, such as a dentist, lawyer, or architect. However, keep in mind that California does not allow LLCs to perform professional services. Such professionals will have to use other business structures such as limited liability partnerships or corporations instead.

If your business sells or leases merchandise, you will need a seller’s permit from the California Department of Tax and Fee Administration. Also, keep in mind that if the name you do business under is a trading name or any name other than the legal name of your LLC, you must file for a fictitious business name.

For more information on the permits, your business will need to check with the Governor’s Office of Business and Economic Development. Here you can find much more information about any permits required to file your LLC with the State of California.

Step 4: File Your Articles of Organization With the State

Now, it’s time to file you’re your article of organization. You can file this form with the State online for a faster processing speed. However, you can file this form by mail as well, or even in person.

California requires Articles of Organization to include a few specific points, and these include:

There is a $75 fee for filing your Articles of Organization with the State of California, but before you fill out the form, make sure you know whether you will be filing as a domestic or foreign LLC.

Domestic LLCs are businesses that are based in and do business in California. For this kind of LLC, you will fill out Form LLC-1. However, the other option is to file as a foreign LLC These are those businesses formed in another state but doing business in California. For this option, you will file Form LLC-5.

After submitting, generally, you can expect the State to take about a week to process your Articles of Organization. For more exact estimates, the state updates expected processing times regularly.

Once approved, you will receive a stamped copy of the stamped Articles of Organization to keep in your files. Additionally, you will receive a twelve-digit I.D. number to identify your business on certain state paperwork.

Okay, you have made it far, and you can now legally do business. However, there are a few more steps to keep your business legal from here on out.

Step 5: Make an Operating Agreement for Your CA LLC

California requires LLCs to draw up an Operating Agreement and have its members agree to it. This can be done right before or after the Articles of Organization are filed. The State does allow a verbal agreement, but a written agreement works better.

Certain things should be included in an operating agreement which we will list below.

You don’t need to file your LLC’s operating agreement with the State of California. Just be sure to keep it safe.

Step 6: File Your Statement of Information

If you form an LLC in California, you must file a Statement of Information. You will need to file this with the Secretary of State within 90 days of filing your Articles of Organization and then every two years. You can send the form by mail, take it in person, or submit it online. You need to pay a $20 fee with it.

The Statement of Information is intended to keep all of the information the State has about a business up to date and accurate. The State will then have accurate information about vital details such as your registered agent and business address.

Step 7: An LLC’s Tax Obligation

Any LLC that is formed in California or is formed in another state but is registered to do business in California must pay four different taxes.

1. Franchise Tax: The franchise tax is an $800 tax that every LLC needs to pay annually.

2. Gross Receipts Tax: A California LLC pays a gross receipts tax on its total revenue. Here are the brackets and applicable tax.

3. Personal Income Tax: The income from an LLC passes through to its members. It then gets taxed as part of the member’s personal income tax.

4. Payroll Taxes: If your LLC has employees, you must withhold payroll taxes for your employees. As an employer, you must also pay your share of the payroll taxes.

These are the major types of taxes an LLC must pay, although you may need to pay other taxes such as sales taxes as well.

Step 8: Fulfilling the CA Federal Requirements

There are a few federal requirements you must comply with as an LLC member, which we will explain below.

Pros and Cons of Forming an LLC in California

Pros

Cons

It’s good to consider these pros and cons when deciding whether to form an LLC If you don’t need the legal protection, forming a sole proprietorship or partnership involves less paperwork. The taxes are easier to determine as well.

Want Some Affordable Help in Forming an LLC? — Here Are The Best LLC Formation Services to Start an LLC in California

#1: ZenBusiness

ZenBusiness is another LLC formation service that provides clearly priced packages and an excellent reputation. You may also want to check out our full review of Zenbusiness here.

Pros

Cons

#2: IncFile

IncFile has a free LLC formation service, which is hard to beat, they also have a number of other advantages and a couple of disadvantages. You might as well read our full review of IncFile here.

Pros

Cons

Conclusion

LLCs are a popular form of business in California due to their flexibility and the legal protections they offer business owners. But, they do have a downside. LLCs may actually pay more taxes than other business types, such as corporations in California.

So, if you are interested in starting a business in California, you should carefully consider all of your options. An LLC may be the best choice; but, it depends on what you want. If you’re looking for legal protections, an LLC is a great way to achieve this. If you want low taxes along with legal protections, a corporation could be a better choice in some cases. But, you’ll want to discuss this with a lawyer.

F.A.Q.s About California’s LLCs

Can I Deduct My LLC Formation Costs?

Up to $5000 of the formation costs of an LLC can be deducted. There are several costs included in these formation costs that you can deduct.

- Lawyer fees

- Costs of forming your business

- The fees for drafting your LLC operating agreement

- LLC filing fees

- The fees for composing and filing your Articles of Organization

The I.R.S. considers single-member LLCs disregarded entities and taxes them like sole proprietorships. So, the tax deduction for organizational purposes is limited to $5000.

You could decide to be taxed as a corporation instead. Then, you could deduct $5000 the first year and anything over $5000 over the next 180 months. However, if your business expenses were over $50,000, your first-year deduction will be lowered by that amount.

Some of your LLC expenses that occur after your LLC is formed are also deductible. You can deduct the $800 annual tax you pay along with any annual fees from your federal income taxes. Maintenance costs such as registered agent fees and business license fees can also be deducted.

What Taxes Will I Have To Pay On My California LLC?

Federal Taxes

You won’t have to pay federal taxes on your LLC income because the LLCs income is taxed as part of your personal income. It will be reported on your personal income tax returns.

State Taxes

You will need to pay an annual tax to the State for your LLC You will pay this tax to California’s Franchise Tax Board. The tax is $800 per year, although the tax is waived for the first year.

Therefore, if a business uses a calendar year, the tax will be due on April 15 of the second tax year for the business. It will then be due by April 15, every tax year after that.

If your business uses a fiscal year instead of a calendar year for tax purposes, the $800 tax will be due by the 15th day of the fourth month of the second fiscal year for your business. It will be due at this same time every year after that.

There are a couple of special situations. If your LLC is started after December 17 and you don’t start doing any business until the beginning of the next year, you will not need to count the last two weeks of the year as a tax year. Your tax year will start in January.

Self Employment Taxes

If you are a member of an LLC, you need to remember to pay self-employment taxes as well. However, you will be able to deduct half of this tax as part of your business expenses. Although, if you are not an active member of a manager-managed LLC, you may not need to pay self-employment taxes. You will want to check with a tax professional if you are in this situation.

Can I form an LLC outside of the State my business operates in?

If you form your LLC in California, you need to have a physical office in California. However, you can do your actual business in a different state. Although you will need to consider the requirements of the State you are actually doing business in and make sure to follow them.

Even if you aren’t required to register your business in the State you are actually doing most of your business in, you may find it advantageous to do so. This is true because you can’t enforce contracts in a state unless you register your business there.

Also, you may have higher taxes if your LLC is registered in a state other than the one in which you live. In most states, you have to pay personal income taxes on your income. Yet, you will probably also need to pay taxes on this money in the State in which your LLC is located.

So, unless your home state gives you credit for the taxes you paid in the other State, you will be paying taxes twice on your LLC income. This is one disadvantage to forming your LLC outside of your home state.

Can I form an LLC for my cannabis-related business?

Recreational marijuana use became legal in California beginning on January 1, 2018. Therefore, you can now file Articles of Organization with the California Secretary of State to form an LLC in cannabis-related business.

Although, even if you file your Articles of Organization with the California Secretary of State, you still may not be ready to legally operate a cannabis-related business. You will need to obtain the necessary licenses to be able to conduct cannabis-related business

To do this you’ll need to file licensing application with Cal Cannabis Cultivation Licensing, the Bureau of Cannabis Control, or the Manufactured Cannabis Safety Branch. depending on whether you want to grow, sell, test, or manufacture cannabis-related products.

It’s possible that you will need to file with more than on of these agencies. So, be sure to check the state regulations. Also, check what you need to do to fulfill any city or county laws in your area. For some help, take a look at the Secretary of State’s California Cannabis Portal.

How do I end (terminate) my LLC?

Once you form your LLC, you will have to pay the taxes and fees associated with it whether or not the LLC is actively running. This will be the case until you legally end the LLC.

To end your LLC, what you need to do is file a Certificate of Cancellation and, if necessary, a Certificate of Dissolution with the Secretary of State of California. If you need more information on this subject, you can check out the website of the Secretary of State of California. Be sure to learn about the tax consequences of ending your LLC as well.

Learn How to Form an LLC in Any U.S. State:

Alabama

Alaska

Arizona

Arkansas

California

Colorado

Connecticut

Delaware

Florida

Georgia

Hawaii

Idaho

Illinois

Indiana

Iowa

Kansas

Kentucky

Get Some More Knowledge About Business & LLCs