Chicken Road Gambling Game

Try our new gambling game – Chicken Road. Play online, bet as small as £0.01 and win up to £14,900. Sign up now through our official partners and claim your welcome bonus of £750 + 50 FS!

We at InOut Games developed Chicken Road as a real-money crash game where every choice can either multiply your stake or burn the chicken down and finish the round. Choose the difficulty level wisely and think fast to win more!

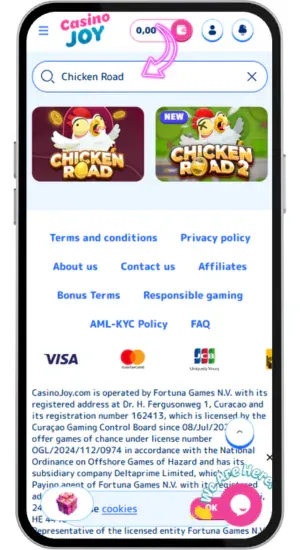

Top Casino Sites Offering Chicken Road

What is Chicken Road?

Chicken Road is a gambling mini-game created by our studio, InOut Games. It’s built around quick decisions — you must cash out before the danger hits. No spins, no reels — just short rounds and risk control.

| Parameter | Value |

| Type | Crash-style mini-game |

| Developer | InOut Games |

| Minimum Bet | £0.01 |

| Maximum Win | £10,000 |

| Volatility (Difficulty levels) | Low / Medium / High / Hardcore |

| Round Duration | ~5–60 seconds |

| Platforms | Mobile and Desktop |

| Controls | Manual and Auto Cashout |

What makes our game stand out is the adjustable risk and how fast each session plays out. You control the outcome — not chance.

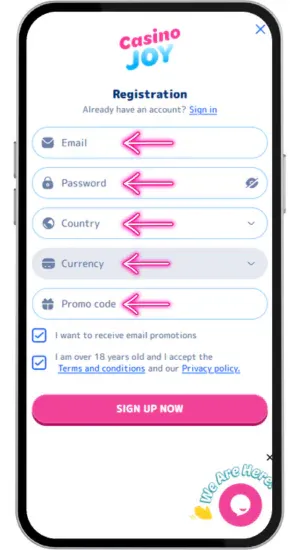

How to Begin Playing Chicken Road for Real Money

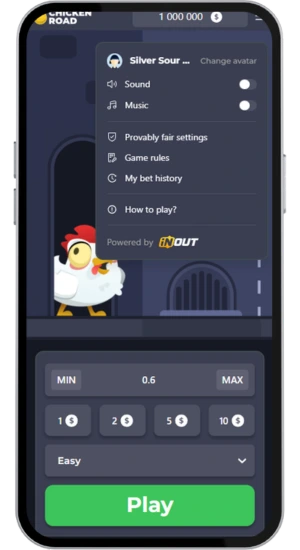

The gameplay is fast, and the interface resembles a dungeon escape – simple to follow, but built around risk. To play our Chicken Road game with real stakes, follow the quick setup process below.

Why Choose Our Game?

The Chicken Road gambling game was designed by our team at InOut Games to be simple but unpredictable. With a non-standard mechanic and rounds that last only seconds, it rewards quick thinking and smart timing. Every outcome is provably fair, and payouts can reach up to £10,000.

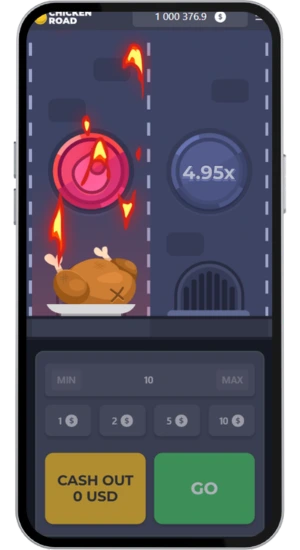

Fresh & Unique Game Mechanics

Unlike typical slots or card-based games, our Chicken Road relies on timing and player decisions. You watch the flame rise and must cash out before the hit. There are no spins, reels, or RNG-based reels — just a reaction-based format with manual control over the outcome.

Competitive RTP

The RTP in Chicken Road casino mode is 98%, putting it above most crash and mini-games on the market. This rate gives players more value per bet and increases long-term profit potential. Even a roasted chicken run can end in a payout if timed correctly.

Low to High Betting Options

Chicken Road betting starts from just £0.01 and goes up to £150 per round. This wide range allows both casual players and those chasing larger payouts to find their level. The flexible limits work for both low and high-risk playstyles.

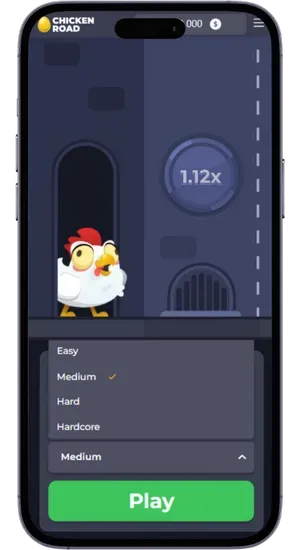

Adjustable Volatility and Difficulty Modes

The Chicken Road gambling game gives you full control over volatility by provides four difficulty levels. Each one comes with different risks, stage lengths, and payout ranges — ideal for tailoring your bet strategy.

- Easy: 24 stages, low risk. Loss chance: 1 in 25. Multiplier: x1.02 to x24.5.

- Medium: 22 stages, moderate risk. Loss chance: 3 in 25. Multiplier: x1.11 to x2,254.

- Hard: 20 stages, high risk. Loss chance: 5 in 25. Multiplier: x1.22 to x52,067.39.

- Hardcore: 15 stages, extreme risk. Loss chance: 10 in 25. Multiplier: x1.63 to x3,203,384.8.

Thanks to these four modes, you can shift from safe plays to high-risk decisions based on your current goals. This structure gives dynamic control over how each session unfolds, from steady growth to one-shot payouts.

Winning Potential in Chicken Road

Below is a breakdown of actual odds tied to multipliers in our Chicken Road betting. These figures reflect real math behind the game, not estimates for you to always know the exact risk behind each round.

| Multiplier | Chance to Win |

| x1.03 | 95.14% |

| x1.12 | 87.5% |

| x1.23 | 79.6% |

| x1.47 | 66.6% |

| x1.63 | 60% |

| x1.98 | 49.5% |

| x4.95 | 19.7% |

| x1000 | 0.098% |

This layout shows how odds shift as you hold longer. Whether you’re going for x1.03 or x1000, each rooster run has its own real probability.

Strategic Tips to Help You Win

Chicken Road rewards smart, consistent decisions over blind risk. The tips below apply to any session length or difficulty mode and help you reduce unnecessary losses.

- Start with low difficulty: Easy mode gives more control and helps you get used to round timing.

- Set a target multiplier: Don’t wait forever — choose a goal like x1.23 or x1.47 and stick to it.

- Use auto cashout: This tool removes emotion and secures winnings when your chosen multiplier is reached.

- Don’t chase losses: Reset your bet amount after a failed round instead of doubling it.

- Track your bankroll: Limit your daily spend and stop playing once you reach your win or loss cap.

Using these small adjustments, you can turn short rounds in Chicken Road into more consistent outcomes across time.

Preview: Game Screenshots